Unlock Financial Freedom: Your Guide to Buying a Reverse Home Mortgage

Comprehending the ins and outs of reverse home mortgages is important for house owners aged 62 and older looking for financial liberty. As you consider this alternative, it is crucial to comprehend not just how it works however likewise the effects it might have on your economic future.

What Is a Reverse Home Mortgage?

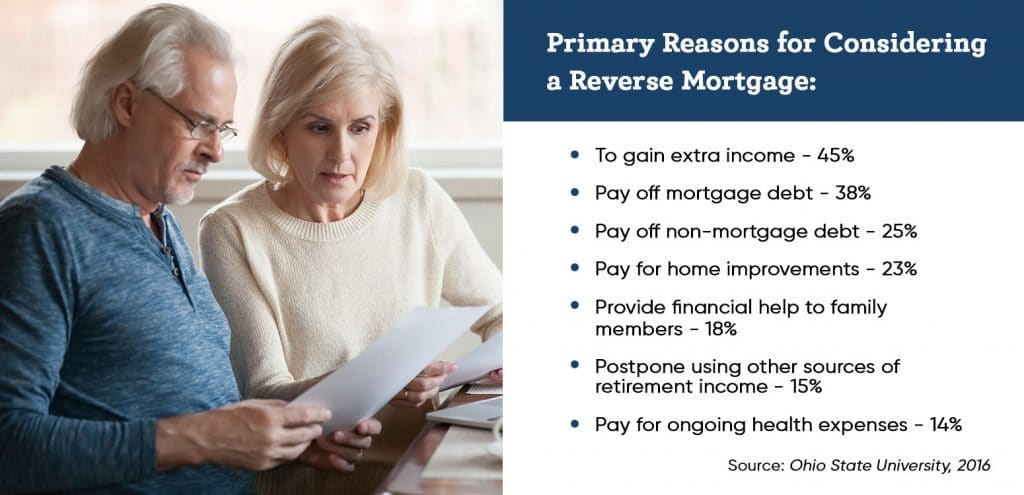

The essential allure of a reverse home loan lies in its possible to enhance monetary flexibility throughout retirement. Homeowners can make use of the funds for different objectives, including medical expenses, home renovations, or daily living expenses, therefore supplying a safety and security internet during an important phase of life.

It is vital to understand that while a reverse home mortgage permits raised capital, it likewise decreases the equity in the home gradually. As rate of interest collects on the exceptional financing balance, it is important for prospective debtors to thoroughly consider their long-term financial plans. Consulting with a reverse mortgage or a financial advisor expert can give beneficial understandings right into whether this alternative straightens with a person's economic objectives and circumstances.

Eligibility Needs

Understanding the eligibility requirements for a reverse mortgage is crucial for homeowners considering this financial option. To qualify, applicants have to be at least 62 years old, as this age requirement enables elders to access home equity without regular monthly home loan settlements. Additionally, the homeowner needs to inhabit the home as their main residence, which can consist of single-family homes, certain condos, and produced homes fulfilling specific standards.

Equity in the home is another crucial demand; house owners usually need to have a substantial amount of equity, which can be identified through an appraisal. The quantity of equity available will straight influence the reverse home mortgage quantity. Applicants have to demonstrate the capacity to maintain the home, consisting of covering home tax obligations, homeowners insurance coverage, and upkeep prices, making sure the home continues to be in good problem.

Furthermore, possible customers need to undergo a financial evaluation to review their income, credit history, and total economic situation. This evaluation helps lending institutions determine the applicant's capacity to meet continuous obligations connected to the home. Fulfilling these requirements is vital for securing a reverse home mortgage and ensuring a smooth financial change.

Advantages of Reverse Home Mortgages

Various advantages make reverse mortgages an appealing alternative for seniors aiming to boost their monetary adaptability. purchase reverse mortgage. One of the primary benefits is the ability to convert home equity right into cash money without the requirement for this hyperlink month-to-month home mortgage settlements. This attribute permits elders to access funds for various needs, such as clinical expenditures, home renovations, or daily living expenses, consequently relieving economic anxiety

In addition, reverse home loans supply a safeguard; senior citizens can continue to reside in their homes for as lengthy as they satisfy the funding demands, promoting stability throughout retired life. The earnings from a reverse home loan can also be used to postpone Social Security advantages, possibly leading to greater payouts later.

Additionally, reverse mortgages are non-recourse car loans, implying that customers will never owe greater than the home's worth at the time of sale, securing them and their successors from monetary obligation. Lastly, the funds received from a reverse mortgage are usually tax-free, including an additional layer of economic relief. On the whole, these benefits setting reverse check these guys out mortgages as a sensible service for elders seeking to enhance their economic circumstance while keeping their cherished home atmosphere.

Charges and costs Entailed

When thinking about a reverse home loan, it's necessary to be conscious of the numerous costs and charges that can influence the total financial picture. Comprehending these costs is vital for making an educated decision regarding whether this financial item is appropriate for you.

One of the primary costs related to a reverse mortgage is the source charge, which can vary by lending institution yet usually varies from 0.5% to 2% of the home's evaluated worth. In addition, property owners must expect closing expenses, which may include title insurance policy, assessment charges, and credit report costs, typically amounting to numerous thousand bucks.

One more considerable cost is mortgage insurance premiums (MIP), which shield the lending institution versus losses. This charge is normally 2% of the home's value at closing, with a continuous annual costs of 0.5% of the continuing to be loan balance.

Finally, it is essential to take into consideration continuous expenses, such as real estate tax, home owner's insurance, and maintenance, as the customer remains responsible for these expenses. By meticulously reviewing these costs and fees, house owners can better analyze the monetary effects of seeking a reverse home loan.

Steps to Obtain Started

Starting with a reverse mortgage includes numerous essential actions that can help enhance the procedure and ensure you make educated decisions. Evaluate your economic circumstance and establish if a reverse home loan straightens with your lasting objectives. This includes assessing your home equity, existing debts, and the requirement for added revenue.

Next, research study numerous loan providers and their offerings. Seek credible institutions with positive reviews, transparent cost frameworks, and affordable rates of interest. It's important to contrast conditions and terms Recommended Reading to find the very best suitable for your demands.

After selecting a loan provider, you'll require to finish a comprehensive application procedure, which generally requires documentation of income, assets, and residential property information. Take part in a counseling session with a HUD-approved counselor, who will provide understandings right into the ramifications and duties of a reverse home mortgage.

Verdict

In final thought, reverse home loans provide a practical option for seniors looking for to boost their monetary stability during retired life. By transforming home equity right into easily accessible funds, house owners aged 62 and older can attend to different monetary requirements without the pressure of month-to-month settlements. Recognizing the details of qualification, advantages, and connected expenses is crucial for making informed decisions. Mindful factor to consider and preparation can lead to improved quality of life, guaranteeing that retired life years are both safe and secure and fulfilling.

Comprehending the intricacies of reverse mortgages is necessary for homeowners aged 62 and older seeking economic flexibility.A reverse mortgage is an economic product created primarily for house owners aged 62 and older, allowing them to convert a part of their home equity right into cash - purchase reverse mortgage. Consulting with a reverse home loan or an economic advisor expert can give valuable insights right into whether this alternative aligns with an individual's monetary objectives and circumstances

Furthermore, reverse home loans are non-recourse loans, implying that consumers will certainly never owe more than the home's worth at the time of sale, shielding them and their heirs from financial responsibility. Generally, these benefits setting reverse home mortgages as a useful service for senior citizens seeking to enhance their monetary circumstance while maintaining their cherished home environment.